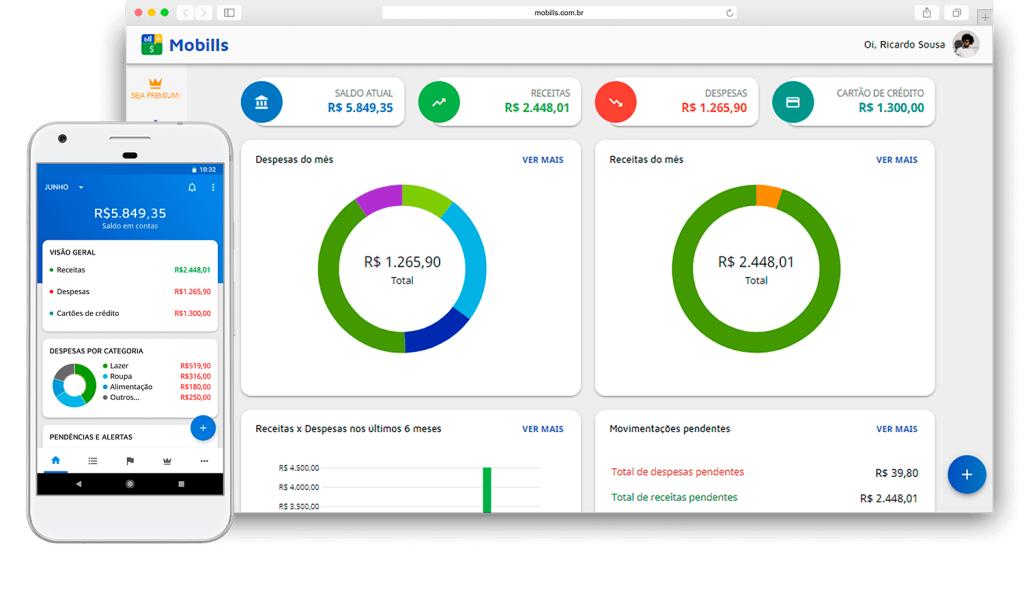

Finances are troublesome sometimes, and keeping and controlling them with ease, in one place, is important for our peace of mind. Mobills budget app is an excellent program that permits people to take control of their finances.

With Mobills, you can create a monthly budget, which will help you control your finances and even save some money.

Mobills budget app allows users to control their money, observing transactions, tracking spendings, and setting achievable goals. All that happens in one place, in one app.

Features

Planning your monthly finances is essential to have your money under your control. If you know yourself as a spender, then the Mobills budget app is ideal for you since it will help you keep everything you do with your money in one place. You can check your transactions and savings, so you will always know when you are low on cash for the things that matter to you.

Mobills is also helpful in paying bills so that you won’t have to rely on different online banking applications to move money. It also comes with a straightforward and user-friendly interface that is excellent for everyone, including those who are not tech-savvy.

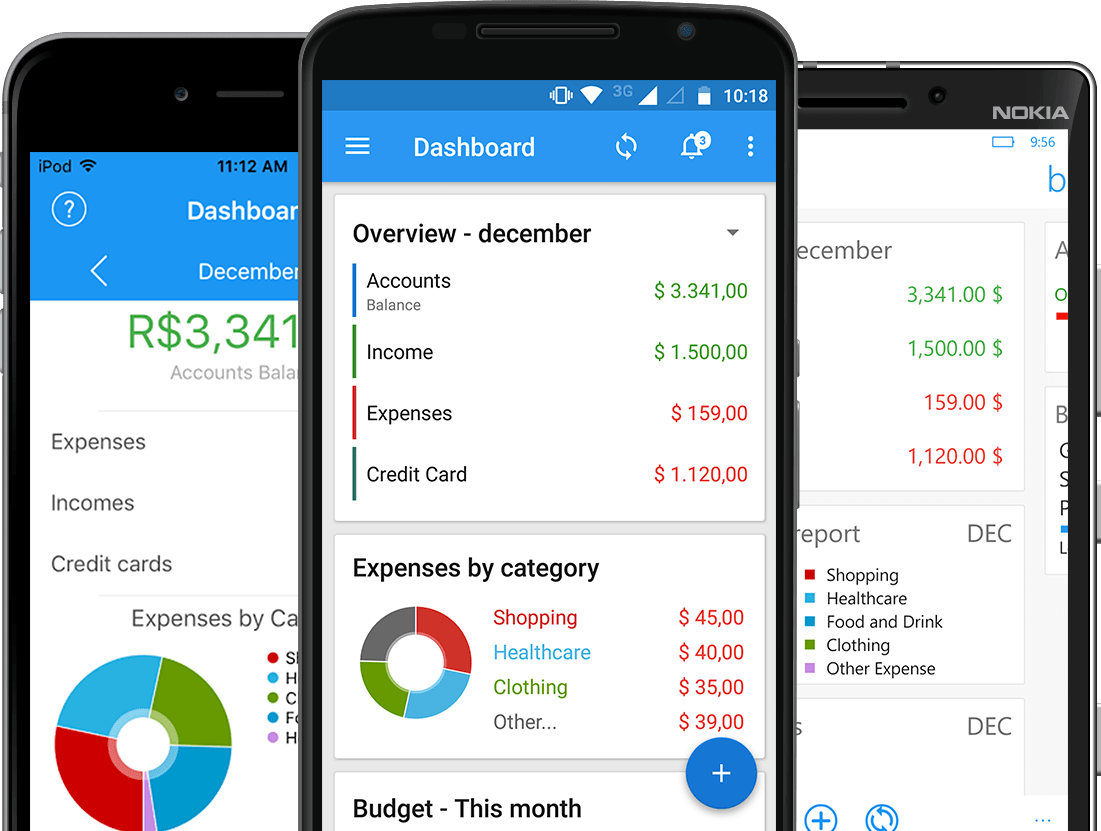

The Mobills budget app replaces spreadsheets, notes, bank statements, and other papers that you may be using now to keep control over your finances. You’ll have everything in one application so that you can easily oversee every transaction. With graphs and reports, Mobills permits you to analyze your financial status. Categorize your budget to plan your monthly finances quickly.

With Mobills, you can manage all your debit and credit cards in one application. You can even set up payment deadlines, and the app will notify you when you have to pay a bill. You don’t have to worry about the security and the safeness of your data since the Mobills budget app comes with the highest privacy features in the field.

Image this! Without visualization of your monthly expenses, you cannot genuinely know where your money goes, every time. An application to show everything you do with your finances is useful to limit your spending when you set up goals or even remind you when you have to pay for something.

In short, the Mobills budget app replaces all the other banking applications and XLS spreadsheets that you may be using right now to oversee your spending and income.

Here are some features of the app.

- Credit and debit card manager

- Personalized reports and graphs

- Filters for users to search for bills, tags, categories, and more

- Cloud sync, either offline or online

- Manages your financial goals

- You can see where you have spent money.

- Save your receipt in the app.

- Save reports in Excel formats, OFX, and/or PDF.

- Payment reminder

- Shows money flow graphs, either monthly or Annual

How to Use and Download

The Mobills budget app is available on Android via Google Play Store. Remember that this application is only helping you to set financial goals, oversee your transactions, control your money, and save money, among other things. The best part is that you can easily add all your cards into one place and view every transaction that you make.

Mobills permits users to see their entries and spendings via user-friendly graphs and reports that can then be exported as spreadsheets or PDF files. In the app, you have the option to set payment and bill reminders.

This is useful for people with a heavy schedule, who do not always have time to pay their bills when the moment comes. Mobills budget app takes care of that, notifies you, and you can quickly pay the bills online.

To plan your budget, you must first set your financial goals. “Set Budgets” is the section that you need to access. From there, you can also check the expense tracker to overview all your transactions.

After a few months of usage, the Mobills budget app can predict how much money you will have at the end of the month, depending on your history of entries and payments. That works regardless of your currency. Mobills functions with some currencies from around the world, and you can quickly choose the appropriate one from the Settings section.

Pricing

The Mobills budget app comes with a free version that has some limitations. The premium variant of the application comes with all the before-mentioned features. The Mobills Premium app is available at $24.99 per year or $14.99 for only three months. Obviously, it’s much more affordable to opt for the 1-year subscription plan.

Summary

In conclusion, it might be tricky to keep your finances under control, especially when you use several banking applications to check your income, transactions, or spending.

Luckily, the Mobills budget app lets you add all your debit and credit cards in one place so that you can easily see whatever is going on with your cash flow. That helps you set goals, pay bills, get bill reminders, and many more.